The banks that have registered with NSDL for e-filing purposes can offer their customers an online facility to view, download and print their Form 26 AS. It is advisable to download and keep a copy of Form 26 AS for future reference. The form will be available for download after you have entered your PAN and selected the Assessment Year for which you wish to view it.Ĩ. You can also download Form 26 AS from the TRACES portal in PDF format.ħ. To view Form 26 AS from your bank account, you need to log into your net banking or mobile banking account and look for the Form 26 AS (Tax Credit Statement) option in the menu.Ħ. Once logged in, go to the 'My Profile page and click the 'Form 26 AS link under the Tax Credit Statement section.ĥ.

You can also view Form 26 AS from the new income tax portal by logging into the income tax portal.Ĥ. Once you have successfully logged in, you can access Form 26AS by clicking on the 'View Tax Credit Statement(Form 26AS)' option available under the 'My Account' section.ģ.

You can view Form 26 AS by logging into the TRACES portal.Ģ.

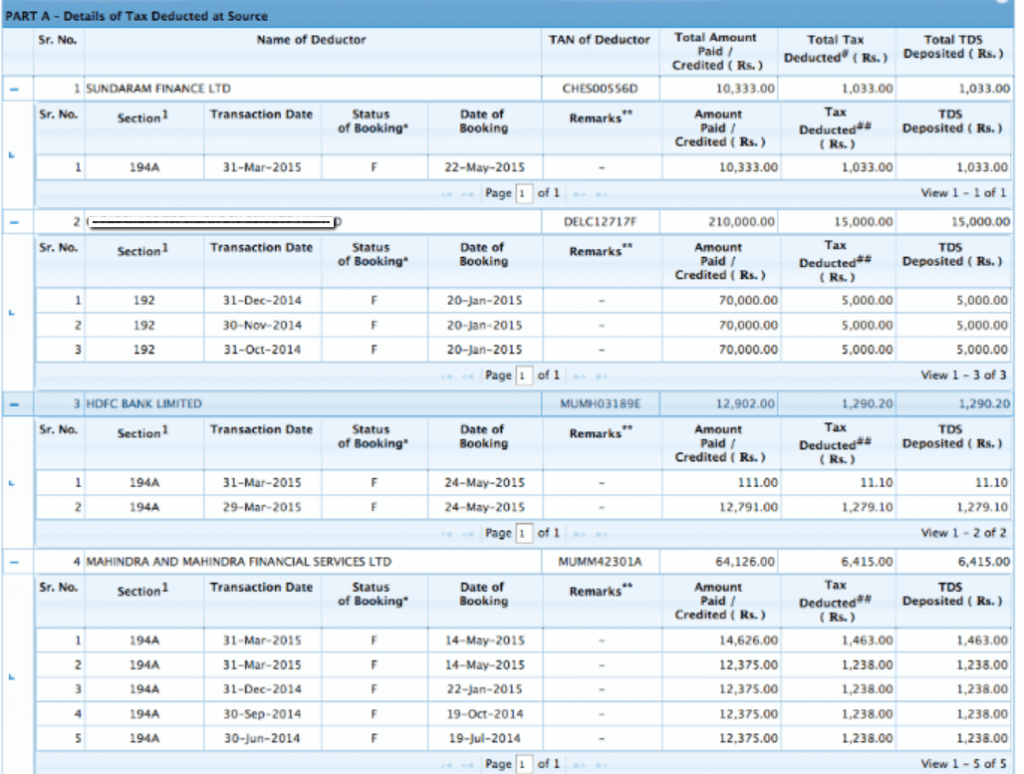

Part A - contains information related to the Tax Deducted at Source (TDS), and TCS Tax Collected at Source.Form 26 AS consists of the following parts:

0 kommentar(er)

0 kommentar(er)